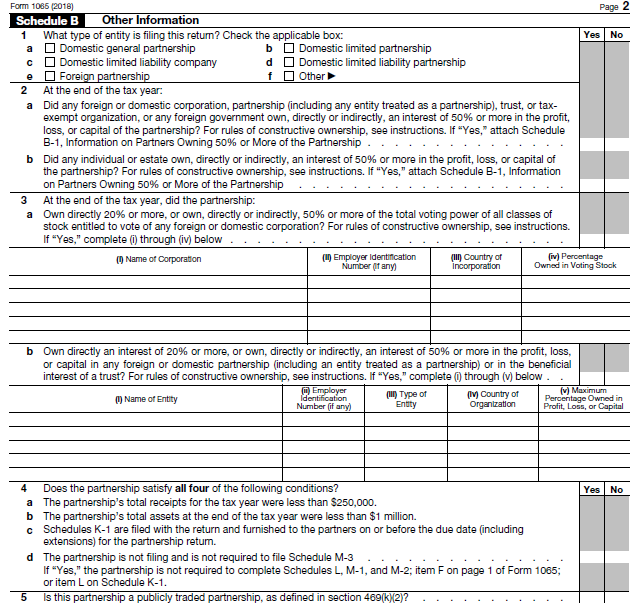

You’ll also need to provide your Employer Identification Number (also known as your Tax ID), your Business Code Number, the number of partners in your business, start dates for the business, and information about whether your company uses the cash, accrual, or other method of accounting. If your business sells physical goods, you’ll need to have information for calculating cost of good sold such as beginning and ending inventory values. To file Form 1065, you’ll need all of your partnership’s important year-end financial statements, including a profit and loss statement that shows net income and revenues along with all the partnership’s deductible expenses_, and a balance sheet for the beginning and end of the year. If your company is an LLC with 2 or more members and has not decided to be taxed as a corporation this year, then you will file taxes as a partnership and you must submit a 1065.įoreign partnerships with more than $20,000 annual income in the United States, or those who earn more than 1% of their income in the United States, must file Form 1065. Your partnership agreement might say you’re a general partnership, a limited partnership, or a limited liability partnership. Not sure if your business is a partnership? Most partnerships are spelled out in a formal written agreement called a partnership agreement, and are registered in the state in which they do business.

Unlike a corporation, a partnership is not a separate legal entity from the individual owners unless that partnership is also an LLC. The IRS defines a “ partnership” as any relationship existing between two or more persons who join to carry on a trade or business. The course and instruction delivery are geared toward a basic understanding and progress to more complex issues via Surgent’s “Step-by-Step” preparation guide.All partnerships in the United States must submit one IRS Form 1065 unless there was no income or expenditures for the year. We bring it all together in the final two chapters with a comprehensive example that integrates and links all previous chapters. Within each chapter, we illustrate various parts and areas of interest when preparing a 1065, including examples and corresponding tax forms. Common to advanced issues of partnerships are explored in the current course that can double as a quick and practical reference guide for tax treatment and tax preparation guidelines. The objective of this course is to train new, rusty, or returning-to-practice staff with a hands-on, pencil-pushing gold standard for preparing Form 1065.

0 kommentar(er)

0 kommentar(er)